Table of Content

They are regarded as having each been allowed the deduction for a year of assessment and will be notified of their respective deduction status ---- sections 26E and 26E. You would need to understand the terms self-occupied-property, let-out-property, and deemed-let-out-property, before we look at the tax benefits. The AMT exemption will be $71,700 for individuals, with a gradual phaseout at $510,300. Married couples filing jointly will see their exemption raised to $111,700, with a phaseout limit of $1,020,600.

Different rules apply to the mortgage interest deduction depending on whether your second home is considered a personal residence or a rental property. The federal tax code allows you to deduct from your taxable income the mortgage interest you paid. To claim this deduction, you must be a homeowner who itemizes your tax deductions on Schedule A of Form 1040. You can’t claim mortgage interest on your tax return if you take the standard deduction. There are rules you must heed when deducting mortgage interest, particularly if you have more than one home.

Can Interest on a Camper Be Deducted From Federal Taxes?

Form 9000, Alternative Media Preference, or Form 9000 allows you to elect to receive certain types of written correspondence in the following formats. The IRS Video portal (IRSVideos.gov) contains video and audio presentations for individuals, small businesses, and tax professionals. The following IRS YouTube channels provide short, informative videos on various tax-related topics in English, Spanish, and ASL. Because $15,000 is the smaller of items 1 and 2, that is the amount of interest Don can allocate to his business.

That depends on what kind of debt you already have–and how much more you want to assume. If you are married and file jointly, you can only deduct interest on $1 million or less worth of home acquisition debt and $100,000 or less worth of home equity debt overall. If single, or married and filing separately, then your limits become $500,000 for home acquisition debt and $50,000 home equity debt, respectively. Tables and figuresDeductible home mortgage interestFully deductible, determination of , Fully deductible interest.How to figure , Table 1.

Below The Total Mortgage Debt Limit

Where To Deduct Your Interest Expense Form 1040, Schedule F, Table 2. Where To Deduct Your Interest Expense Form 1098, Form 1098, Mortgage Interest StatementForm 8396, Mortgage interest credit. TAS works to resolve large-scale problems that affect many taxpayers. If you know of one of these broad issues, report it to them at IRS.gov/SAMS. Organization within the IRS that helps taxpayers and protects taxpayer rights.

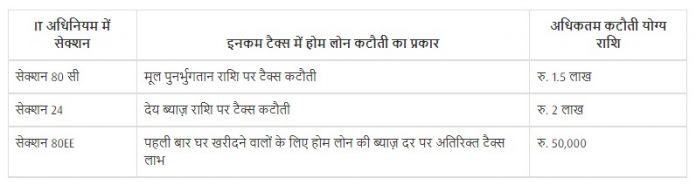

Property ratio should be determined as per property document and remains constant. However, w.r.t loan, one can claim deduction according to the payment done by each co owner respectively. For the full tax deduction of Rs. 2 lakh on interest amount, the property must be fully constructed within five years of taking the loan. Home loan interest deduction can be claimed in five equal instalments after the property is fully constructed.

Apply Now

You can also submit your Home Loan interest certificate and sanction letter to your employer for TDS deductions. A house is more than just a place to live; it is an asset to be treasured. And if you have the means to invest in a second asset, you should!

If you are a homeowner who received assistance under the HAF, the payments from the HAF program are not considered income to you and you cannot take a deduction or credit for expenditures paid from the HAF program. Different tax rules apply to the mortgage interest deduction depending on whether your second home is considered a personal residence or a rental property. With rentals, the number of days you rent the property—as opposed to living in it yourself—also comes into play. In most cases, single filers and those married filing jointly can deduct all of their mortgage interest on up to $750,000 of mortgage debt.

Value Limit

Her writing has appeared in Travel+Leisure, USA Today, and Fodor’s, among others. Patrice has shared her expertise on-air with segments on the Today Show, WEtv, and The Nate Berkus Show, and she was the Savvy Shopper reporter for WPIX in New York City. Lea has worked with hundreds of federal individual and expat tax clients.

There may be a situation where you would have to rent out both houses and live in a rented accommodation yourself. Below are the tax benefits you can avail in such scenario. You can only deduct interest payments on principal loans of up to $750,000 if married but filing jointly and $375,000 if you’re filing independently if you bought a home after December 15th, 2017. Another influencing factor could be the exemptions set out for the AMT, otherwise known as the Alternative Minimum Tax. This applies mainly to high-income taxpayers so that they’re not using various tax credits to avoid paying their fair share of tax. In case both your homes have been rented out, the rental income from these homes will be taxed.

If i have purchase one HL in dec 2019 which interest is 80k now and another HL on Nov 2021 which interest would be 2.5 L. Can I claim 2 L under Sec 24 for new property and 80K under Section 80EEA. If you endure any loss above ₹2 lakh, you can carry it forward for the following eight assessment years. TPA (full form – Third Party Administrator) is a licensed interm...

News, discussion, policy, and law relating to any tax - U.S. and International, Federal, State, or local. The IRS is experiencing significant and extended delays in processing - everything. If you are still paying EMIs for your first home loan, the application for a second home loan will be similar to the first one. Approaching your existing lender is the best in this case, as the approval will be quick. In case of deemed let out houses, the rent earned should be marked around the same price as of the similar properties in the area. The deemed let out property’s rent should be around the same amount for the properties in that area and that amount has to be shown under income.

For debt secured after December 15, 2017, the limit is $750,000 ($375,000 if married filing separately). Mortgage Basics - 6-minute read Andrew Dehan - October 28, 2022 Homeowners can’t deduct homeowners insurance from income taxes, unless it’s a rental property. Learn more about which homeownership expenses are tax deductible.

The role of stamp duty is primarily found in property transactions. If you are living in a different city, you can claim tax rebates for the home loan as well as HRA provided you are staying as a tenant. Check under which section you can qualify for a home loan tax rebate.

How to Get Tax Benefits on Second Home Loan

Their job is to ensure that every taxpayer is treated fairly and that you know and understand your rights under the Taxpayer Bill of Rights. The IRS uses the latest encryption technology to ensure that the electronic payments you make online, by phone, or from a mobile device using the IRS2Go app are safe and secure. Paying electronically is quick, easy, and faster than mailing in a check or money order.

No comments:

Post a Comment